Bookkeeping

What Is a Statement of Retained Earnings? What It Includes

Shareholders, analysts and potential normal balance of retained earnings investors use the statement to assess a company’s profitability and dividend payout potential. Retained earnings are also known as accumulated earnings, earned surplus, undistributed profits, or retained income. At 100,000 shares, the market value per share was $20 ($2Million/100,000), however, after the stock dividend, the market value per share reduces to $18.18 ($2Million/110,000).

Losses to the Company

It may be done, however, if management believes that it will help the stockholders accept the non-payment of dividends. Shareholders equity—also stockholders’ equity—is important if you are selling your business, or planning to bring on new investors. In that case, they’ll look at your stockholders’ equity in order to measure your company’s worth. As an investor, one would like to know much more—such as the returns that the retained earnings have generated and if they were better than any alternative investments.

What is the retained earnings formula?

Lack of reinvestment and inefficient spending can be red flags for investors, too.That said, calculating your retained earnings is a vital part of recognizing issues like that so you can rectify them. Remember to interpret retained earnings in the context of your business realities (i.e. seasonality), and you’ll be in good shape to improve earnings and grow your business. If your company pays dividends, you subtract the amount of dividends your company pays out of your retained earnings. Let’s say your company’s dividend policy is to pay 50 percent of its net income out to its investors. In this example, $7,500 would be paid out as dividends and subtracted from the current total.

1: Retained Earnings- Entries and Statements

- This information will be listed on the balance sheet under the heading “Retained Earnings.”

- Retained earnings and profits are related concepts, but they’re not exactly the same.

- But while the first scenario is a cause for concern, a negative balance could also result from an aggressive dividend payout, such as a dividend recapitalization in a leveraged buyout (LBO).

- Normally, the entity’s senior management team proposes the dividend payments to the board of directors for approval.

- Retained earnings offer internally generated capital to finance projects, allowing for efficient value creation by profitable companies.

For instance, the first option leads to the earnings money going out of the books and https://www.bookstime.com/ accounts of the business forever because dividend payments are irreversible. It reconciles the beginning balance of net income or loss for the period, subtracts dividends paid to shareholders and provides the ending balance of retained earnings. This is the net profit or loss figure from the current accounting period, from which the retained earnings amount is calculated.

The entity may prepare the statement of retained earnings and the balance sheet and the statement of change in equity. Normally, the entity’s senior management team proposes the dividend payments to the board of directors for approval. The company’s retained earnings calculation is laid out nicely in its consolidated statements of shareowners’ equity statement. Here we can see the beginning balance of its retained earnings (shown as reinvested earnings), the net income for the period, and the dividends distributed to shareholders in the period. A company’s retained earnings balance can be found on the shareholder’s equity section of the balance sheet (one of the 3 core financial statements), which can be found in the company’s annual report or website.

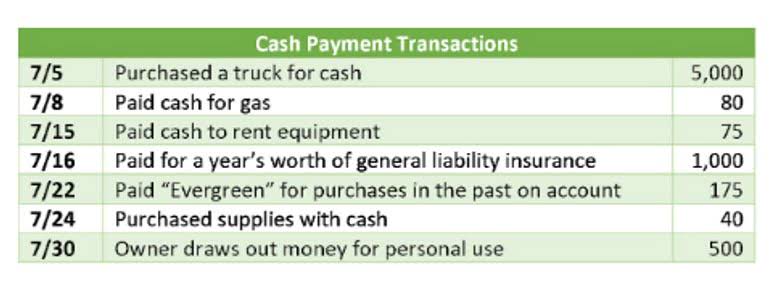

Cash Flow Statement

A net profit would mean an increase in retained earnings, where a net loss would reduce the retained earnings. As a result, any item, such as revenue, COGS, administrative expenses, etc that impact the Net Profit figure, can impact the retained earnings amount. Typically, the net profit earned by your business entity is either distributed as dividends to shareholders or is retained in the business for its growth and expansion. So, retained earnings are the profits of your business that remain after the dividend payments have been made to the shareholders since its inception. If you see your beginning retained earnings as negative, that could mean that the current accounting cycle you’re in has a https://x.com/BooksTimeInc larger net loss than your beginning balance of retained earnings.

Step 5: Prepare the Final Total

When the accounting period is finalized, the directors’ board opts to pay out $15,000 in dividends to its shareholders. If the company is not profitable, net loss for the year is included in the subtractions along with any dividends to the owners. Dividend payments can vary widely, depending on the company and the firm’s industry.