Bookkeeping

Cash Trap: A Comprehensive Exploration of Definition, Impact, and Accounting

With Fed rates at a 23-year high, bonds offer attractive yields that match or exceed cash rates, with the added benefit that their value will increase amid rate cuts. And coupon rates are fixed, whereas cash returns will drop alongside rates. If rates do not fall it suggests that the economy is stronger than expected, which will enhance earnings and support stock gains. Cash does not drop in nominal value, and about a fifth of investors in the Capital Group survey believe it delivers an adequate return.

Consequently, growth just compounds the cash drain unless it also leads to superior market share. Cash trap refers to a situation in which a company experiences a significant slowdown in its cash flow, leading to restricted liquidity and financial flexibility. This occurs when a substantial portion of a company’s financial resources intuit ein number becomes tied up in non-liquid assets, such as inventory, accounts receivable, or long-term investments. Consequently, the company faces challenges in meeting its short-term obligations and maintaining day-to-day operations. Historically, the typical manufacturing company with typical growth rates and asset turnover had to have a pretax profit of about 7 percent on sales, or the entire company became a cash trap.

- Even if you escape from such a cash trap eventually, you have still lost.

- Cash trap refers to a situation in which a company experiences a significant slowdown in its cash flow, leading to restricted liquidity and financial flexibility.

- Seek legal counsel to ensure a comprehensive understanding of the implications.

- Even as interest rates fall, paying down debt is prioritized and new lending and investment grind to a halt.

Financial Institutions

For the situation to qualify, there must also be a shortage of bondholders wishing to keep their bonds and a limited supply of investors looking to purchase them. Instead, the investors are prioritizing strict cash savings over bond purchases. A cash trap in the context of contracts refers to a wave accounting 2020 situation where the contractual terms and conditions unexpectedly lead to financial burdens or restrictions for one or more parties. These burdens may arise due to unforeseen circumstances, complex clauses, or legal ambiguities within the contract itself. Cash inflow and outflow are fundamental to the financial health of a business. Cash inflow refers to the movement of money into the company, typically originating from sale receipts, investments, or loans.

Cash outflow, on the other hand, represents the movement of money out of the company, covering expenses, debts, and investments. Japan faced deflation through the 1990s, and in 2022 still has a negative interest rate of -0.1%. Low interest rates affect bondholder behavior, especially when combined with concerns regarding the current financial state of the nation. The end result is the selling of bonds at a level that is harmful to the economy.

Is the U.S. in a Liquidity Trap Now?

A liquidity trap occurs when consumers, investors, and businesses opt to hoard their cash, making the entire economy resistant to policy actions intended to stimulate economic activity. Meanwhile, consumers lean towards keeping their money in low-risk savings accounts. When a central bank increases the money supply, it is putting more money into the economy with the reasonable expectation that some of that money will flow into higher-yield assets like bonds. Rallies in bond and equity markets likely have further to run, particularly if as widely expected central banks cut interest rates.

Delays in receiving payments from customers can exacerbate the cash trap, especially when companies rely heavily on accounts receivable to fund their operations. Ultimately, investors should remember that holding some cash is always necessary. However, they should also recognize that too much cash can become a liability. Despite the comfort that cash can provide, the most prudent move would be to avoid the “cash trap” and step into risk markets. In contracts, a cash trap provision is a contractual clause allowing a lender or contracting party to redirect cash flow from a collateral asset to a third party when the borrower fails to observe certain covenants.

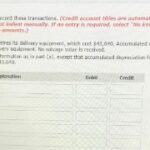

Sale receipts represent the revenue generated by a business through the sale of goods or services to customers. They 3 good reasons to use current construction cost data serve as tangible evidence of financial transactions and contribute to a company’s overall income. Sale receipts can come in various forms, including cash, checks, credit card payments, or electronic transfers. Accounting professionals engage in scenario planning to assess potential cash flow challenges and devise strategies to avoid or mitigate the impact of a cash trap.

Low Demand from Investors

BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place. With higher rates of inflation, the minimum required return is increased in proportion. Inflation of assets must be financed and will never be recovered in dividends or liquidation.

When this condition is reached, the entire reported profit and more can be withdrawn as cash and reinvested elsewhere or paid out. When profit margins are low, the required reinvestment will often exceed the reported profit indefinitely, even in mature stable businesses. If eventual liquidation will produce only a portion of book value, then the reported profit until then is being overstated in proportion.

If the company’s required threshold on investment return is higher than this deflated profit, then the difference represents the company’s annual opportunity cost. Cash flow statements play a crucial role in identifying potential cash traps. Analyzing the patterns of cash inflows and outflows can help businesses identify areas that may be causing liquidity challenges. However, investors should be wary of falling into the “cash trap.” After all, history has clearly shown that one leaves money on the table by not taking some risk in investing. Against this backdrop, how can investors gain the confidence to step out of cash and build long-term, diversified portfolios?